New Yorkers, keep an eye on your mailbox— the first batch of up to $400 inflation refund checks is already en route, bringing a quick financial lift to more than 8 million eligible households. Drawn from a hefty state budget surplus, this $2 billion program is Governor Kathy Hochul’s way of giving back amid sticky prices for rent, food, and fuel. No hassle, no paperwork: If you qualify, the money’s coming straight to you starting late September.

In a year where everyday costs refuse to let up, New York’s latest relief push is landing like a surprise bonus. These inflation refund checks, up to $400 for qualifying families, are set to hit mailboxes through November, injecting fresh dollars into pockets across the Empire State. Backed by excess sales tax revenue from 2023-24, the initiative skips the middleman to directly tackle the inflation hangover that’s left many budgets stretched thin.

For families in high-rent hotspots like NYC, where 3.53 million checks are headed out, this could cover a month’s groceries or chip away at utilities. It’s not a full fix, but in tough times, every bit helps keep the lights on and the fridge full.

Latest on the $400 NY Inflation Refunds 2025

Fresh updates from the New York Department of Taxation and Finance confirm the program’s humming along smoothly, with the initial mailings wrapping up their first round this week. Over 8.2 million taxpayers are tapped in, all based on your 2023 state income tax filing—no late filers or updates allowed this go-around.

To snag your share, you needed to submit Form IT-201 for 2023 and steer clear of being listed as a dependent. If that’s you, congrats: You’re in line for a slice of the pie without lifting a finger.

Eligibility Breakdown and Who Gets What

The refunds are tiered to favor those feeling the inflation bite most, scaling with your filing status and 2023 adjusted gross income. Check the table below to see your potential payout:

| Filing Category | Income Range | Refund Amount |

|---|---|---|

| Single / Married Filing Separately | $75,000 or less | $200 |

| Single / Married Filing Separately | $75,001 – $150,000 | $150 |

| Married Filing Jointly / Qualifying Surviving Spouse | $150,000 or less | $400 |

| Married Filing Jointly / Qualifying Surviving Spouse | $150,001 – $300,000 | $300 |

| Head of Household | $75,000 or less | $200 |

| Head of Household | $75,001 – $150,000 | $150 |

Income over the caps? Sorry, no check this time. This setup keeps things fair, directing the lion’s share to middle- and lower-income folks who need it most.

Payment Schedule: When to Expect Your Check

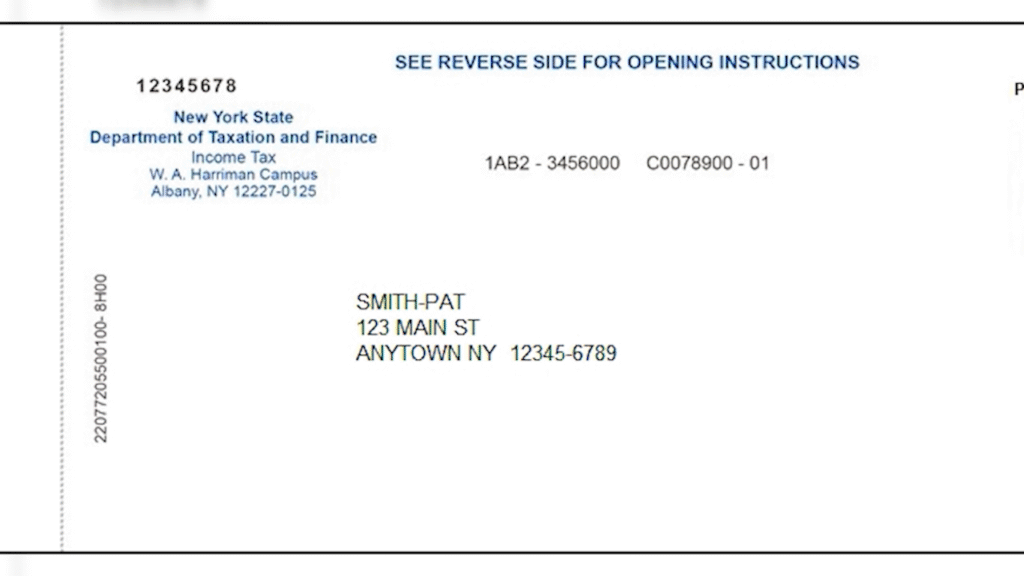

No waiting games here—the Tax Department kicked off mailings at the tail end of September, aiming to blanket the state by November’s close. Checks drop to your 2023 tax address, so if you’ve relocated, loop in the department ASAP to reroute.

The beauty? Total automation means zero forms or fees—just pure, straightforward delivery. Early birds in Syracuse and Buffalo are already posting pics of their hauls, but urban spots like NYC might see a staggered flow due to volume.

Dodging Scams in the Refund Rush

Word’s out, and so are the hustlers. With checks flying, fake alerts about “held payments” or “quick claims” are popping up via text and email. Pro tip from officials: Legit state comms never fish for your SSN or bank deets unsolicited.

If it smells off, trash it and head to tax.ny.gov for the real deal. Hotline reports of shady schemes are climbing, but staying vigilant keeps your refund scam-free.

The Story Behind These Refund

Hochul’s crew spotlighted a revenue jackpot from last year’s sales tax boom—billions extra that inflation ironically handed over. Opting for rebates over bureaucracy, they funneled $2 billion back out, a nod to families grinding through 9.8% food price jumps and 11% utility spikes (BLS stats).

It’s projected to spark a mini-spending spree, propping up corner stores and services when wallets are light. As Hochul put it, this is “your money working for you,” not lost in Albany’s coffers.

Smart Moves for Your Incoming Check

Once that envelope arrives, labeled plainly as your “Inflation Refund,” here’s how to make it count: It’s state-tax-free but pops up on your 2025 federal return, so jot it down for Uncle Sam.

Lost in the mail? Ping the Tax Department pronto—they’ve got protocols. And skip the impulse buys; think gas tank top-off or emergency stash builder for max impact.

What It Means for NY’s Economy

This cash drop isn’t just personal—it’s a statewide jolt. Expect a Q4 bump in retail foot traffic, with economists eyeing a 1-2% consumer spend lift in essentials. In a state battling outmigration and deficits, it’s hailed as savvy surplus-sharing that could inspire neighbors like NJ or CT.

Critics quibble it’s short-lived, but for now, it’s fueling optimism in a recovery that’s uneven at best.

$400 New York Inflation Refund Checks come in 2025 or not?

Yes, the $400 New York Inflation Refund Checks for 2025 are confirmed and currently being distributed. According to the New York Department of Taxation and Finance, mailings began in late September 2025 and will continue through November 2025. Eligible residents who filed their 2023 state income tax return (Form IT-201) and are not claimed as dependents will automatically receive the payment by mail—no forms or reapplication needed. If your check hasn’t arrived by the end of November, you can contact the department via tax.ny.gov for assistance.